The Annasaheb Patil Loan Scheme was started by the Maharashtra Government and is being run by Annasaheb Patil Mahamandal for helping poor people and jobless youth. Under this scheme, interest-free loans from Rs. 10 lakh to Rs. 50 lakh is given so that people can start or grow business. For loans up to Rs. 15 lakh, interest is paid by the government if the loan is returned on time by the person. The loan must be repaid in 5 years and the money can be used for opening business or doing something useful. Many youths was helped already and more can get help too. It is made so that the people can earn money and live better life.

Objective of Annasaheb Patil Loan Scheme

The main aim of Annasaheb Patil Loan Scheme is to help poor people and youths who don’t have job. It was made so that they can start own business. Money is given as loan without interest. This help is given by government. It is done by Annasaheb Patil Mahamandal. The scheme is made for making people strong. Many people was helped and more will be helped. People can use the money for doing work or making shops. Life can be changed by this and It is for giving chance to live better and earn money.

Also Read: Ladki Bahin Yojana 11th Installment Date

Key Highlights of Annasaheb Patil Loan Scheme

| Name of the Scheme | Annasaheb Patil Loan Scheme |

| Launched by | Maharashtra Government |

| Objective | Help poor people start businesses |

| Loan Amount | Rs. 10 lakh to Rs. 50 lakh |

| Interest Rate | 12% per annum |

| Processing Fee | Depends on bank’s rules |

| Repayment Period | Up to 5 years |

| Collateral | Land or movable assets may be needed |

| Eligibility | For Marathas & economically weaker people |

| Mode of Application | Online |

| Official Website | Udyog Mahaswayam Website |

Eligibility Criteria

The eligibility criteria for the scheme are as follows:

- The person must be living in Maharashtra and should be a citizen of the state.

- Male applicants can take this loan if their age is not more than 50 years.

- Female applicants are allowed to apply if they are not older than 55 years.

- This scheme is mainly made for people from the Maratha community who need support.

- It also helps other poor people from weaker sections who have less income.

Benefits of Annasaheb Patil Loan Scheme

Benefits of Annasaheb Patil Loan Scheme are:

- Big loan amount is given without any interest, due to which people don’t have to pay any extra money.

- Poor and jobless people was given a good chance to start their own business and earn.

- The money can be used for opening a shop or doing some useful work to earn daily.

- If the loan is paid back on time, then the government will pay the full interest amount.

- Many families was helped by this scheme and now they are living a better and happy life.

Required Documents

These important documents are required to get this loan scheme, which are as follows:

- Aadhaar Card

- PAN Card

- Domicile Certificate

- Caste Certificate

- Income Certificate

- Passport Size Photos

- Bank Passbook

- Project Report

Rate of Interest and Charges

The Annasaheb Patil Loan Scheme gives loans at 12% interest every year. The bank may also charge a small processing fee, which depends on their rules. Some charges for paperwork may be added, but they are not very high. For different types of loans, interest rates can change. For example, loans for tractors or farm tools may have different rates. If someone takes a loan, they might need to give something as security, like land or other things they own. The rates can also be less for some loans, like for buying a car or house.

Also Read: Ladki Bahin Yojana 11th Installment

Application Process

Application Process for Annasaheb Patil Loan Scheme is mentioned below:

- Step 1: All the interested candidates who want to apply for the loan scheme, can visit the Udyog Mahaswayam Website to begin with the application process.

- Step 2: On reaching the homepage of official website, click on “Registration” option and then a box will pop up on your screen, where you have to click on “click here” option if you are a new user.

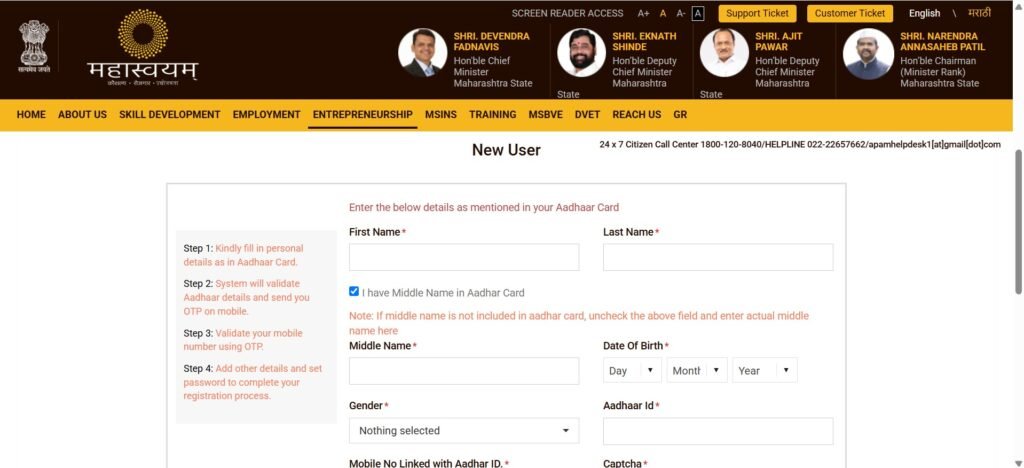

- Step 3: Registration form will appear on your screen, now you have to fill out the registration form with details such as First Name, Last Name, and if you have Middle Name, then select option for it as well, then date of birth, gender, Aadhaar ID etc.

- Step 4: After entering the required details correctly, check for no mistakes, and click on “Next” button.

- Step 5: When you click on “Next” button, you will receive OTP on your registered mobile number, which you should enter in the desired place.

- Step 6: Once you have enter the OTP and details as required, you should click on “Submit” button to complete the application process.

Helpline Number

- Address: Main Building, Room No. 204, Second Floor, Madam Cama Marg, Hutatma Rajguru Chowk, Mantralaya, Mumbai-400032

- Phone: 022-22028301 (Mon-Fri 10:00 to 18:00)

- Toll Free: 1800-120-8040 (24 X 7 Citizen Contact Centre)

- Email ID: desk-adm1[dot]sdeed-mh[at]gov[dot]in

FAQs

Who can apply for the Annasaheb Patil Loan Scheme?

Any Maharashtra resident, especially from the Maratha community or economically weaker sections, can apply for the scheme, provided they meet age and other specified eligibility criteria.

What is the maximum loan amount available?

The maximum loan amount under the scheme is Rs. 50 lakh. Applicants can apply for loans between Rs. 10 lakh and Rs. 50 lakh, based on their business requirements.

What is the interest rate on the loan?

The interest rate for loans under the Annasaheb Patil Loan Scheme is typically 12% per annum, though the rates may vary depending on the type of loan and the bank’s policy.

Is there any collateral required for the loan?

Yes, collateral is required for loans under the scheme. This could include land or movable assets, depending on the loan amount and type. Specific requirements are decided by the bank.

How long is the repayment period for the loan?

The repayment period for loans under the Annasaheb Patil Loan Scheme is up to 5 years. The exact duration depends on the loan terms set by the bank and the applicant’s plan.